Swanson Reed’s Academic Research

TaxTrex was the result of academic research published in the UK’s leading tax journal, TAXATION into the R&D tax relief claim process. It was designed specifically to help accountants and their clients document the R&D process in line with the requirements of HMRC and recent case law.

R&D tax relief requires the taxpayer to document the experimental process and the new knowledge generated. These strict requirements have increased the administrative burden of the entire R&D process.

TaxTrex was designed to provide a simple and systematic alternative for companies wishing to claim. Three surveys, completed in real-time, prompt the taxpayer to document the following information:

- The level of knowledge at the commencement of the project

- The new knowledge generated through experimental activities and their outcomes

- That the purpose of all activities was to generate new knowledge

- The relationship between the R&D activities and any qualifying indirect activities

Each of the items above has proven to be essential to any R&D tax relief claim.

This research was published in a leading tax journal, TAXATION.

IT’S ALL IN THE PAPERS

The government’s tax relief programmes for research and development (R&D) activities are seen as a vital tool for fostering innovation within the UK in an increasingly competitive global landscape. HMRC became more stringent in assessing claims after several high-profile tribunal cases over fraudulent expenditure claims, costing taxpayers millions of pounds.

As a result of political and social pressure from these developments, HMRC adopted new guidelines in April 2019 that raised the standard of care required in submitting a claim. It has shown a willingness to launch enquiries into and reject previously accepted claims, such as ordering a company to refund paid credits – which could spell financial disaster for a company suddenly finding itself with a large tax bill.

Documentation of research projects is a key element in mitigating enquiries by HMRC and properly supporting any claims that do face enquiry. Case law shows the importance of clear and relevant supporting evidence, especially documentation, in substantiating challenged R&D claims. In this article, we identify and categorise common mistakes to inform improved documentation to mitigate the risk of disruptions or financial difficulties caused by an enquiry or rejected claim. The case study Covid Testing Co shows how to identify activities in a project and the documentation that would be required.

DOCUMENTATION STANDARDS AND CASE LAW

Cases such as Hadee Engineering Co Ltd (TC7969) and Grazer Learning (TC8282) provide a useful foundation, as the First tier Tribunal explicitly affirmed the guidelines set out by the Department for Business, Innovation and Skills (later replaced by the Department for Business Energy and Industrial Strategy) on the meaning of R&D for tax purposes:

Key points

- HMRC is increasingly likely to enquire into claims that might have been accepted in the past.

- Documentation of projects is key in mitigating enquiries.

- Reliance on third parties to maintain records is not adequate – the company must keep its own records.

- Details of the project and activities are required.

- Expenses must identifiable and itemised as much as possible.

- Clarify the relationship with any third parties involved in the project.

- The company must clearly identify and demonstrate the advance in science or technology it is seeking to achieve, which must advance overall knowledge in the field.

- The company must identify and demonstrate how the advancement involves the resolution of scientific or technological uncertainty.

- The company must have incurred expenditure on the R&D.

- The expenditure must qualify as an allowable deduction in the given period.

- The expenditure must be incurred pursuant to a project.

- The project must be relevant to the company’s trade.

How detailed should documentation be?

Even where a company has supplied these elements in some form, it could still face challenge over whether the project,

activities and/or expenses are properly qualified. For example, simply claiming a project is ‘R&D’ or listing expenditures under ‘research’ in broad terms is unlikely to be sufficient.

The small body of UK case law has considered several issues (directly or indirectly) relevant to the quality of a claimed research projects’ documentation. Items were derived from cases where companies had failed to sufficiently substantiate a claim, and were grouped into four primary categories:

- Failure to document or keep records.

- Failure to identify the project and activities.

- Failure to identify expenses and attribute them to the project.

- Failure to identify relationships with third parties.

Naturally, every case is unique, but this review of case law aims to provide practical insight for both companies and

advisory firms on the evidentiary expectations of HMRC and the First-tier Tribunal.

CATEGORY 1

Perhaps surprisingly, a failure to keep written records is not considered strictly determinative, but can nevertheless be severely problematic. Two ways in which a lack of written records proved to be precarious was reliance on third parties to keep records for the company, or attempting to rely on oral evidence of managers or other people after the project.

A claiming company cannot rely on third parties to keep records on its behalf. A company may make use of records from a third party, but it is ultimately the company, and not the third party, that bears ultimate responsibility to produce documents and records.

Even relying on third parties who are specialist consultants in R&D tax claims will not alleviate this burden. In Hadee Engineering, when the company’s claim was subject to HMRC review, it had kept little to no documentation and attempted to rely on third parties, including specialist R&D advisers, to provide it.

Unfortunately for the company, the advisers told HMRC it would be difficult to obtain the requested invoices due to its own personnel and system changes. The company – and not the advisers – was ultimately held to be under a duty to retain its own relevant records to substantiate claims.

This is not to say a company may not make use of information from third parties at all, as HMRC has the power to request documents. In Hadee Engineering, HMRC received a number of sales invoices, subcontractor invoices, purchase invoice slips and requisition summaries from a third party. In AHK Recruitment (TC7718), although HMRC ultimately remained unsatisfied and closed the claim, it did communicate with an accountant and consultancy firm to assist with resolving enquiries such as describing the project and providing costs breakdowns.

The case of Teksolutions-Inc Ltd (TC7456) provides an additional cautionary tale on relying on third parties, particularly in terms of information security. Some costs for the project were incurred over the eBay platform. A breach of security somehow led to the applicant’s entire account purchasing history being deleted. The tribunal held that it is not sufficient to rely on third party or ‘cloud’ storage. While it may be possible in a worst-case scenario for HMRC to chase suppliers, in this case the applicant failed to also keep track of who their own suppliers were, meaning copies of the records could not be requested.

Failing to create or keep records (and not being able to blame a third party for any shortcomings) may seem inherently fatal to a claim. Yet, cases show it is not necessarily strictly determinative.

The tribunal has said that ‘although there is no requirement for a plan to be recorded in a particular manner, we would expect some record or documentary evidence’, and elsewhere has looked for ‘clear documentary (or other objective) proof’ (AHK Recruitment). It has also said, however, it would at least take ‘in the absence of which, a detailed explanation’ (Hadee Engineering). Still, any oral claims must be of a clear and detailed standard in the context of available evidence to substantiate that the research or activity in fact took place.

As seen in Hadee Engineering, having not kept records, relying on oral evidence will face some difficulty. The company had a manager provide oral evidence, but it was found to be fragmented and inconsistent.

First, the passage of time was problematic. While some parts of the manager’s testimony were considered clear and detailed, HMRC said the rest had ‘clear issues in relation to [the manager’s] recollection of the projects, so many years after the claim was made; this was apparent from a number of contradictions in his evidence’. The tribunal accepted that ‘the passage of time may have affected [the manager’s] recollection of events’, but nevertheless found that inconsistencies, lack of detail undermined the reliability of the evidence as a whole. It also noted that the manager was not directly involved in the project and as such, the quality of the oral submissions were impaired by the distance between the manager and the project. Additionally, without the benefit of records and documentation, new information was invariably provided during the giving of oral evidence, which was problematic because it ‘did not afford HMRC the opportunity to review or check that evidence’. Ultimately, this led to the conclusion that the ‘evidence was unclear and unreliable’.

In AHK Recruitment, a company relied on witness statements from third parties who advised the company on submitting an R&D claim. Again, the tribunal noted that, of the people from the consulting firm giving evidence, ‘neither was contemporaneously involved in the project and activities underpinning the claim for R&D relief and neither has any direct knowledge of the detail of those activities. Rather, the evidence that each gave was based on what they had pieced together from documents and/or what they had been told by others’. The tribunal acknowledged that the strict rules of evidence do not apply to administrative tribunals, but submissions will nevertheless face scrutiny. A claim would significantly benefit from the presence of at least some corroborating documentary evidence.

Planning in advance with a documentation system would have undoubtedly saved the claimants in these cases significant time and money, not to mention stress.

For planning a documentation strategy, discussion in Hadee highlighted a number of documents that would have been beneficial. This includes:

- contracts or correspondence between the company and its customer, or test reports;

- contracts, purchase orders and correspondence with suppliers and subcontractor;

- sales or purchase invoices for the project;

- the resulting process was also not patented, which could have otherwise been useful as documentary evidence; and

- contracts between the company and the third party (there was no written contract, as they regularly worked together over many years).

As seen in Hadee, AHK Recruitment, and Teksolutions, the burden of proof to substantiate a claim falls squarely on the company and, as such, it is ultimately responsible for its own record-keeping.

When working with third parties, one could consider regularly collecting copies of any external project records held by third parties. A company using document-sharing services such as cloud-based record-keeping systems should make sure to download and keep regular backups. In cases where third parties are more involved, it would appear prudent for acompany to insist on documentation and ensuring it keeps its own copies, given that the burden of proof ultimately rests on the company itself.

AHK Recruitment provides some suggestions on what could help when stuck in the situation relying on oral evidence. These should be provided:

- by people who were ‘contemporaneously involved’ in the project; or

- at least by a competent professional in the field who had ‘expertise such that he/she could state with authority what technology was readily available during the relevant period and how the technology that the appellant sought to develop was materially different to or appreciably improved from that which was readily available’.

CATEGORY 2

While lacking documentation is perilous, the mere presence of documentation will not in itself guarantee a claim. Examples of this include incomplete documentation or reliance on vague or subjective claims.

Where a company has at least kept documentation, it should cover the key five points as described in Hadee Engineering. Failing to do so will make it difficult for HMRC (or a tribunal) to verify whether the claimed work is indeed research. From these cases it is clear that in any claim each and every element must be addressed in some manner, as was put explicitly in AHK Recruitment, where HMRC rejected a claim saying:

‘I require the advance in the overall knowledge or capability in a field of science or technology to be made clear, along with the state of knowledge at the outset, the technical uncertainties encountered by the competent professionals, and what the result was at the end of the period.’

This is a fairly straightforward requirement but is notable as should any element be lacking, it could jeopardise an entire claim. This is what happened in AHK Recruitment where responses to HMRC enquiries did not (at first) include a project description and, second, describe the advance, resulting in closure of the claim. Grazer Learning is another case where a company similarly fell short, by failing to identify its project as an ‘advance’, effectively making the entire claim moot.

Eligible projects must seek to provide some advance that overcomes some technological or scientific uncertainty. The focus of this requirement is on identifying how the advance being pursued faces technical or scientific uncertainty in the process, and to produce evidence that demonstrates a company methodologically undertook R&D activities to resolve it. Mere opinion will be not be enough.

The case of B E Studios v Smith & Williamson [2006] STC 258 demonstrated that the elements of a claim, ie a project, that provides an advance that faces some uncertainty, are subject to an objective test. This means simply labelling something ‘innovative’ or ‘untried’ will not suffice. In that case, the judge said that ‘bare assumption was not a sufficient basis upon which to advance a claim for R&D tax credits to the Inland Revenue, and neither is it a sufficient basis to advance a claim for damages against the defendant’.

In AHK Recruitment, invoices simply describing work undertaken as ‘development’, ‘support’ or ‘web development’ without elaboration were similarly insufficient to identify a project as R&D. This extends to describing the people involved. In one case, asserting that someone was ‘competent through experience’ was not sufficient.

When the elements of a research project are ostensibly addressed in a claim, whether they will be accepted remains an objective test. Hadee Engineering and AHK Recruitment made note of various undocumented items, which creates a short but useful reference list of items that could be considered for record-keeping:

- There was no narrative description of the work subcontracted to other persons.

- No record of the outcome (regardless of success or failure).

- In describing a ‘process that was used to try to achieve the advance’ appellant provided ‘little to no detail on methods used.’

- Extracts from technological journals or industry publications as a few additional examples of what would be considered objective evidence.

These cases also highlighted a positive case of useful documentation, derived from a report not by the company itself but a subcontractor, which provided:

- an overview of main company and nature of its business;

- details of the project(s) and objective of the project, including why current solutions are not sufficient or do not exist;

- the proposed solution;

- a description of the technical challenge faced in reaching the objective;

- the difficulties presented by the challenge;

- details of any prototypes; and

- staff involved and roles (this can include describing competent professionals’ background and qualifications).

While there is no prescribed structure or form, in substance, records should reflect the nature of research – that is, an empirical process. Documentation is ‘required to demonstrate that there was a clear methodology behind the activities which were carried out, such that it identified the uncertainty it sought to resolve and in doing so attempted to produce (whether successful or not) a material change or improvement which added to or extended knowledge in a field of science or technology which was not publicly available or could be worked out by a competent professional in that field without difficulty.

R&D TAX CREDIT TRAINING FOR CPAS

R&D TAX CREDIT TRAINING FOR CFPS

R&D TAX CREDIT TRAINING FOR SMBS

CATEGORY 3

Categories 1 and 2 established that having some form of documentation is beneficial to substantiating a claim, and that the information must be factual and objective. Category 2 focused more on qualifying the project and activities, while category 3 relates more to expenditure.

Expenses must be identifiable, generally itemised as much as possible, and linked to the project activities. Much like determining whether a project is in fact pursuing an advance or not, the determination of expenditure is a factual enquiry. In practice, just as a project cannot be labelled ‘cutting edge’ without further qualification, expenses cannot simply be listed without some means to substantiate them. Putting forward numbers without documentary evidence to support them without providing any details to explain the basis of those figures, would not be enough to establish qualifying expenditure.

Cases have observed that the question is not what expense had been incurred, but what it had been incurred on, and in the context of R&D relief, this being clearly linked to the research. See Vaccine Research Limited Partnership v HMRC and related appeals [2015] STC 179; Marathon Oil UK LLC (TC6217) and CRC v Tower MCashback LLP 1 and another [2011] STC 1143.

HMRC and the tribunals had become particularly strict on this point following Vaccine Research. The relief claimed in this case had quickly attracted the scrutiny of HMRC due to having little in the way of project documentation, instead relying mostly on oral evidence. The Upper Tribunal reaffirmed that the question of expenditure is a ‘factual enquiry’ that must be based on objective, verifiable facts.

Both Vaccine Research and Teksolutions show that both HMRC and the tribunal will readily scrutinise what it deems scant documentation in the way of financial data. In particular, vague or broad categorisations, such as simply ‘other debtors’ or ‘other expenditure’, will raise concerns.

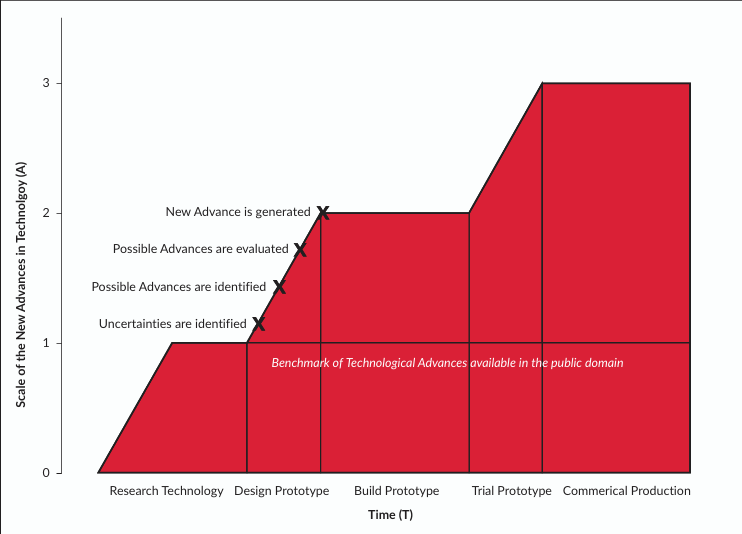

COVID TESTING Co.

This case study shows how to identify activities in a project and the documentation that would be required.

Covid Testing Co (a fictional company) is developing a new type of Covid-19 antibody test kit by combining two existing finger prick blood sampling processes in a novel way to provide a more sensitive test (Test Kit Project).

As part of the design process, various theoretical calculations are performed, including computer model simulations of the testing kit and how it can detect antibody subgroups. The company then constructed a prototype testing kit for laboratory testing.

It identified the following activities as part of the project

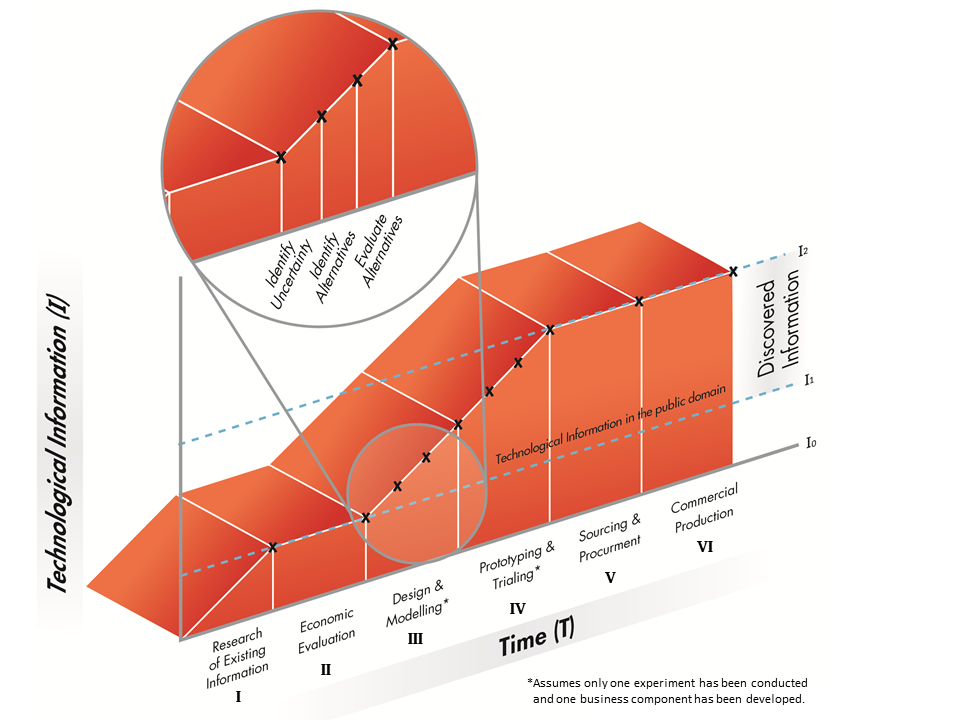

| Activity | Description | Classification | Documentation items | |

| A | Research Technology (Market research) | Identification of gap in the market and potential demand for more advanced and accurate testing kits | Not qualifying – Market research |

|

| A | Research technology (Administration and financing) | Prepare a proposal for management which goes to the board and then, upon approval, allocation of finance and resources | Not qualifying – Management/ operational/commercial activity | |

| A | Research technology (Literature review) | Set a benchmark for the new knowledge to be gained, through a review of existing binding and neutralising antibody testing technologies | Not qualifying – Possible supporting activity directly linked to design activity |

|

| B | Design Prototype (Conceptual and detailed design) | Development of an initial product design followed by detailed calculations on its theoretical workings, including use of computer simulations. As outcome cannot be determined in advance based on current knowledge; ie based on the literature review, the information available is inadequate to help determine, for certain, that combining two existing processes in the method employed will improve accuracy or sensitivity of the testing kit | Qualifying activity – Provided a new advance is produced |

|

| C | Build prototype | Build prototype using a 3D Printer | Not qualifying – A simple 3D print generates no new advances. Activity could be qualifying in its own right if the build was more technical than a simple print. |

|

| D | Trial and test prototype | Experimental method of performing tests, recording results, and reiterating. (This includes negative or false positive results) | Qualifying – Experimentation: Scientific method is applied to test a hypothesis about the testing kit performance by experimenting with a new method, observing the results of the experiment, and evaluating the outcome in view of making a logic conclusion; and activities are conducted for the purpose of generating new knowledge about the improved kit design; eg if the improved design performs as anticipated, the hypothesis is proved; if the improved design fails, the hypothesis is disproved. Testing the sensitivity of the new kit using theoretical calculations and computer simulations. Observation: Recording the results of the experiment, including computer modelling predictions and results from theoretical calculations. Evaluation: Analysing and assessing the effectiveness of the predicted kit accuracy against design specifications. Determining whether further design changes are necessary to meet design specifications. |

|

| E | Commercial production | Manufacture successful working prototypes | Not qualifying – Activity generates no new advances. This activity may in itself meet the requirements separately. |

|

Failure to identify expenses in detail and failure to connect them to the R&D will be deemed insufficient evidence for the HMRC to verify a claim. Among the lacking items generally referenced were various financial documents, such as contracts, purchase orders and correspondence with suppliers and sales or purchase invoices. Teksolutions reiterated the need for detailed, itemised breakdowns of items such as salaries and wage, subcontractor costs, detailed descriptions of the consultancy services used and copies of all invoices. The failure to produce copies of invoices for consumables has also made expenditures unverifiable.

The case of Research & Development Partnership Ltd (TC271) discussed the standard of financial records and provided a non-exhaustive sample of what is likely to be considered suitable documentation:

- a detailed explanation of its R&D tax relief claim;

- a breakdown of staffing costs;

- copies of its invoices and bank statements;

- an analysis of ‘other debtors’;

- copies of board minutes authorising the payment of dividends;

- returns and accounts for the relevant accounting periods and copies of related nominal ledger; and

- records of agreements between the applicant and potential associated companies (or a detailed explanation).

AHK Recruitment also suggested some examples of breakdowns for costs, in which HMRC had requested under ‘appropriate headings of staff, externally provided workers, subcontractors, software and consumable items’.

CATEGORY 4

As mentioned earlier, a company cannot rely on third parties to keep records. Building on this, when a company works with third parties on a project, it is important to clearly identify this relationship.

There are several reasons why unclear working relationships with third parties can attract scrutiny.

When subcontracting work to another company, it may raise questions about who is actually undertaking the R&D. In Hadee, the tribunal noted that the contractual nature of the relationships with the company and its customers were relevant to identifying who was conducting R&D, any contracting-out arrangements and who owned any intellectual property. In this case, the company had received ‘significant payments’ from its customers linked to claimed R&D projects, but without providing further explanation. This was problematic as it was not possible to verify that the claimed expenditure was not entirely subsidised by the payments from the company’s customers – and therefore unclaimable. On closer investigation, it turned out the company was reimbursed for its time spent on R&D, which the customer provided the concept and was heavily involved in the design.

Research and development is a high-risk activity. HMRC was sceptical of the claim, because it found it implausible that the company would accept the full risk of researching a niche area without some form of commission from its customer. No contracts were provided to HMRC to identify the terms of any engagements, but it determined though invoices and emails that design time was charged to customers. For the company to claim R&D relief, the tribunal rightly recognised that this would be wrongfully doubling up on benefits.

Suggestions

The previous categories provided examples of basic documentation that will identify the relationship between a company and third parties, such as contracts or correspondence between the company and its customer, or contracts, purchase orders and correspondence with suppliers and subcontractors. Being legal documents, these should generally help to classify the relationship between the parties.

As discussed in category 3, expenses must also be clear and traceable, broken down and itemised where possible, enabling an onlooker (such as HMRC) to identify to where, or in the case of expenses – to whom, the expenditures are attributed.

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725. Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

Swanson Reed’s R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.