How does TaxTrex work?

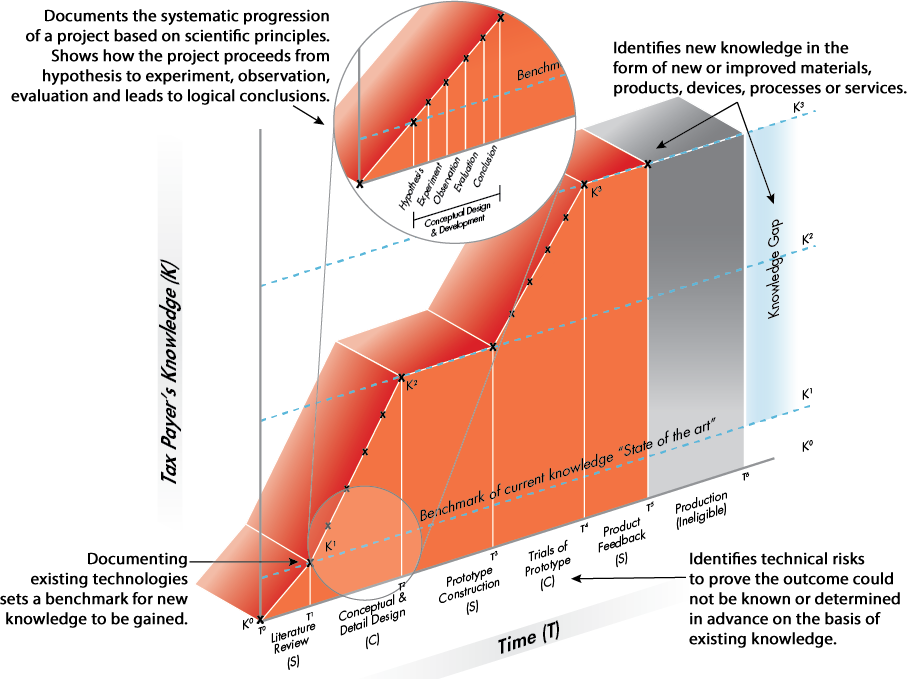

TaxTrex complies with AusIndustry requirements by collecting the following data through 3 real-time surveys:

- Benchmark of knowledge prior to project commencement

- New knowledge generated through documented experimental activities

- Relationship between experimental activities and their directly related activities

This research was published in Australia’s leading tax journal, Taxation in Australia.

Compliance burden or insightful planning?

Changes to the definition of eligible activities; uncertainties around the definition of new terms, such as dominant purpose; and recent decisions handed down in the Administrative Appeals Tribunal (AAT) regarding substantiation have all contributed to additional uncertainty for taxpayers during the transition to the new R&D Tax Incentive.

In the AAT, a number of decisions have been handed down, deciding against taxpayers on the basis that the documents provided were insufficient or inappropriate for substantiating the R&D claims.

While the recent decisions deal with applications under the former Concession, they offer an insight into a new ‘best practice’ that AusIndustry and the Australian Taxation Office (ATO) will require of taxpayers when claiming under the Incentive.

How do you document and still make enough to pay the bills in an increasing world of regulation and AusIndustry red-tape?

This R&D tax article provides an overview of the new requirements, examines the implications of the AAT decisions, discusses the difference between documentation and substantiation, and provides a case study.

INTRODUCTION

Changes to the former Concession program were instigated following the 2008 Review of the National Innovation System, which recommended that the government increase the base Concession, but refine the definition of R&D and/or establish limits on eligible expenditure.

As the chairperson of the expert panel tasked with reviewing Australia’s national innovative system, Dr Terry Cutler led the panel to examine “the coherence and effectiveness of existing Government support for innovation”, “identify gaps and weaknesses in the innovation system” and “develop proposals to address them”.[ii] The findings were published in Venturous Australia, which is also known as the Cutler Review.

To encourage innovation by Australia-based businesses, the Cutler Review recommended that:

- “the existing R&D Tax Concession … be replaced with a Tax Credit in order to raise the level of business expenditure on research and development by providing a less complex and more predictable support mechanism”; [iii]and

- “[f]urther exploration … to see if there are practicable ways of expanding the definition of eligible activities to include some of the less technically risky activities involved in innovation in services”. [iv]

To curb large R&D claims for “commercial” activities, the Review recommended that:

- “guidelines … be reviewed to clearly identify what is eligible activity”; [v] and

- “appropriate measures be taken to heavily constrain ‘whole of mine’ and similar claims against the existing R&D Tax Concession program or proposed Tax Credit program”. [vi]

Following the recommendations of the Review to drive innovation by increasing the benefits for businesses that take on the risks of conducting R&D activities, it may appear that the changes made to the R&D program are counter-intuitive to the overarching recommendation of the Review.

In an effort to minimise claims on commercial activities, the new, stringent record-keeping requirements and the uncertainty around the new legislation are deterring companies from lodging applications under the Incentive program — despite the potentially generous benefits — because they are unsure whether they are meeting the requirements. Small–medium enterprises (SMEs), in particular, may determine that the cost of administration outweighs the benefits of claims.

The following table outlines the positive and negative aspects of the Incentive as identified to date:

Positive aspects of the Incentive

- Faster processing times for registrations and payment (relative to the Concession).

- More certainty around the nature of core and supporting activities (particularly, in the registration form).

- No limits on the amount of expenditure subject to a refundable offset (previous limit was $2 million).

- Up to 50% of expenditure can be incurred overseas subject to certain requirements (previous limit was 10%).

- An exempt entity can own up to 50% of an eligible company claiming R&D (previous limit was 25%).

Negative aspects of the Incentive

- Delayed release of guidance materials from the ATO and AusIndustry.

- Delays in responses for companies that have sought Advanced Findings (private rulings).

- Uncertainty around the dominant purpose test criterion within the context of a production environment.

- Uncertainty around the scope and application of feedstock provisions (particularly, with prototypes)

- Uncertainty around substantiation sufficiency (AAT decisions have only clarified what is insufficient).

AusIndustry will be conducting the first round of compliance reviews under the Incentive over the second half of the 2013 financial year. The assessment format and tactics employed by AusIndustry will be influenced by both the form of the new legislation and content within the recent AAT decisions.

OVERVIEW OF THE NEW REQUIREMENTS

Under the Incentive, taxpayers are required to self-assess each of their activities as either core or supporting and provide contemporaneous documentation to support their assessment.

According to the new Tax Laws Amendment Act (Research and Development) Act 2011, documentation for core activities must demonstrate the following:

1. The scientific method is applied:

- the activity is experimental;

- involved a systematic progression of applied work that was based on science principles; and

- proceeded from hypothesis to experiment, observation and evaluation; and led to logical conclusions.

2. New knowledge is generated:

- the activity is conducted for the purpose of generating new knowledge, including new knowledge in the form of new or improved materials, products, devices, processes or services; and

- the outcome could not be known or determined in advance on the basis of current knowledge, information or experience. [vii]

Familiar terms under which the Concession operated, such as systematic, investigative and experimental activities, innovation and technical risk, have been replaced by new terms such as new knowledge, experimental activity and scientific method. However, there is no clear definition as what each term constitutes, how they should be documented and the extent to which activities should be documented to be compliant.

According to the 2011 Act, supporting activities are activities directly related to core R&D activities. Where the supporting activities are conducted in a commercial setting, they are subject to exclusion unless it can be proven that they have been undertaken for the dominant purpose of supporting the core R&D activities.

The key differences in substantiation requirements between the Incentive and the Concession are outlined in the table below:

| Concession Regime | Incentive Regime |

|

|

|

|

|

|

|

Under the Incentive, a core activity is substantiated by documenting its systematic progression, which must be based on scientific principles. A supporting activity is substantiated by documenting the nexus between the main purpose of the supporting activity and the progression of a core activity.

Due to these requirements, the Incentive has more stringent documentation requirements than that of the Concession.

However, there is growing anxiety among taxpayers that without a statutory substantiation framework, similar to that of the Concession, uncertainty around sufficiency and practicality of maintaining adequate documentation will increase the risks of their R&D claims not meeting the more stringent requirements.

R&D TAX CREDIT TRAINING FOR CPAS

R&D TAX CREDIT TRAINING FOR CFPS

R&D TAX CREDIT TRAINING FOR SMBS

Implications of AAT Decisions

AAT decisions have addressed the issue of substantiating activities for R&D tax purposes; but as a recent decision has yet to be made in favour of a taxpayer, questions relating to the sufficiency of documentation and the practicality of successfully substantiating a claim remain unanswered.

In a bid to demystify the process of substantiating activities under the Incentive, different views have been expressed on how to identify and measure innovation (or the scientific method) within a core activity.

However, there can be no one-size-fits-all method to substantiation. Given the intimate relationship between the identification of an activity and the documentation required to support that activity, an activity could be substantiated in different ways.

Confidential v IR&D Board

Since 1985, it has been asserted, in principle, that R&D activities involving the creation of new knowledge or innovation could be substantiated by demonstrating the presence of either quality in the outcome of an R&D project.

In Confidential v IR&D Board [1997] AATA 67, Deputy President McMahon commented that:

“If what is produced is an innovative product then the activity must, as a matter of logic, involve innovation.” [viii]

McMahon J’s comment presents a reasoning that before an experimental activity that involves a specific quality (ie innovation) can be substantiated, that quality must first be identified.

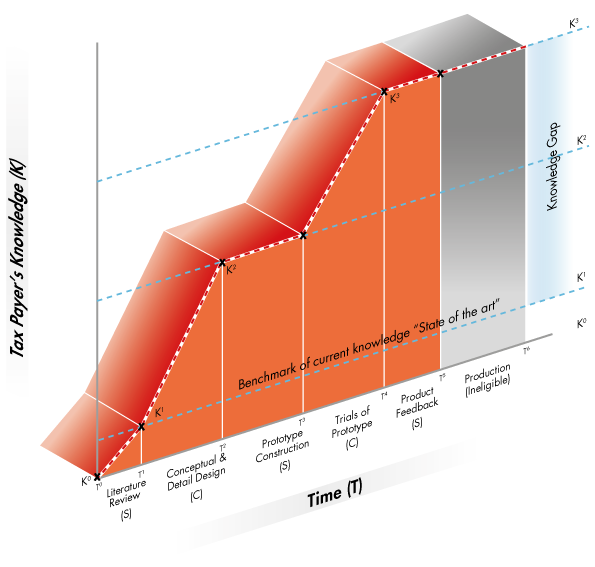

Here the Tribunal has:

- assumed that the creation of the new product can only occur through creating new processes;

- assumed that that new processes were created using the scientific method; and

- measured the knowledge gap by considering the level of new knowledge in the final outcome of the activity against the existing state of knowledge that was reasonably accessible prior to the commencement of the activity.

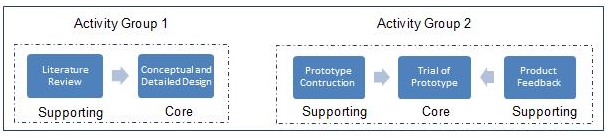

From a product development perspective, this rationale could be identified graphically as shown below. The documented points are labelled with a cross:

Figure 1 — Demonstration of knowledge gap though the documentation of two points

Figure 1 shows that the core activity named “Conceptual and Detailed Design” is eligible where:

- a literature review detailing the state of knowledge prior to starting that core activity (K1) can be produced; and

- a finalised schematic of the detailed design highlighting the new knowledge within the core activity (K2) can be produced.

RACV v Innovation Australia

Recently, however, in the case of RACV Sales and Marketing Pty Ltd v Innovation Australia [2012] AATA 386, this long-established principle was disputed. Referencing the case of Jones v Dunkel [1959] 101 CLR 298, Deputy President Forgie presented a reasoning that that was polarising to Deputy President McMahon’s reasoning in the Confidential case. Forgie J said:

“One does not pass from the realm of conjecture into the realm of inference until some fact is found which positively suggests [so]; that is to say [a fact] that provides a reason, special to the particular case under consideration, for thinking it likely that in that actual case a specific event happened or a specific state of affairs existed.” [ix]

Forgie J’s comment suggests that innovation within an activity cannot be assumed to have occurred without producing evidence of the state of affairs that led to its occurrence.

HZXD v Innovation Australia

This idea is further emphasised in the recent decision of HZXD v Innovation Australia [2010] AATA 879, where Deputy President McDonald and Tribunal Member Ermert said:

“The first thing to determine is the activities in which the applicant was engaged. The usual way in which activities are determined is by reference to records. Usually, records will be in a documentary or computer-generated, time-sequenced form and consist of R&D plans, outcomes of test results …” [x]

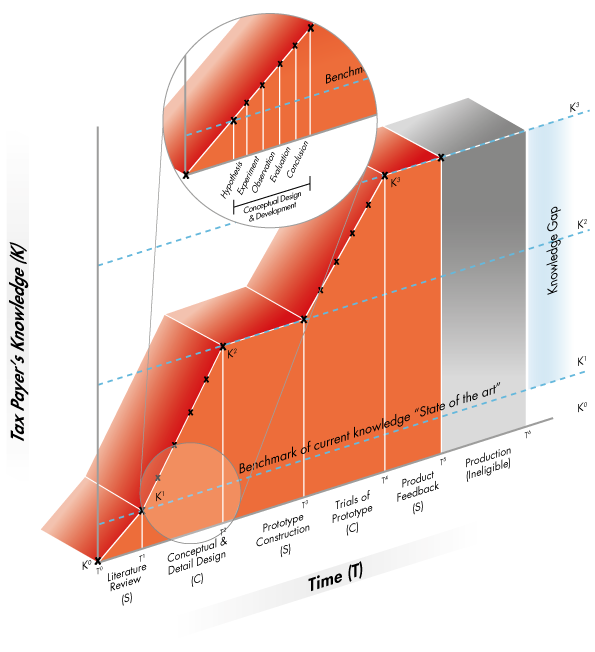

The decisions of the HZXD and RACV cases suggests that in order to assess innovation within an activity, the series of iterative steps leading to its final outcome must first be examined (ie the scientific method).

DBTL v Innovation Australia (Mt Owen Case)

The recent AAT decision, DBTL and Innovation Australia [2013] AATA 573 (DBTL or Mt Owen Case) was a well resourced AAT case that related to the R&D activities conducted by a large coal producer at the Mount Owen mine site.

In this case, the Tribunal found that all activities were ineligible on the basis of inadequate substantiation of hypothesis and evidence of ‘purpose’ for generating new knowledge.

“We accept the evidence of Mr Alexander that this activity was not “experimental” but was rather a well-established mining procedure and that it has not been shown to have been undertaken to make a discovery or test a hypothesis…” [ix]

Although it was not disputed that the ‘through-seam blasting’ activity occurred, the Applicant could not demonstrate through documentation that it was conducted to test a hypothesis of any-kind.

This reasoning is illustrated in Figure 2 below. The documented points are labelled with a cross:

Figure 2 — Demonstration of the knowledge gap through a series of iterative steps (or points)

The basis of the DBTL, RACV and HZXD decisions forms an extension of the view expressed in the decisions of the Confidential case. That is, in addition to substantiating the state of knowledge at the start of the project and the innovation or level of knowledge in the final product, the process between those two variables must also be documented.

Documenting v Substantiating: The Importance of Evidence

For the taxpayer, the crucial question is then: what is the difference between documenting and substantiating?

Under Australia’s self-assessment tax regime, the taxpayer is responsible for providing evidence of compliance with any tax requirements to the assessor (in this case, AusIndustry or the ATO). The assessor is not responsible for interpreting a taxpayer’s documents in a way that would assist the taxpayer in meeting legislative requirements. For the most part, the taxpayer is responsible for:

- adequate documentation of the experimental activities to be claimed; and

- adequate communication of the nature of those activities to the assessor, in the event of a review.

NaughtsnCrosses v Innovation Australia

In the recent AAT decision of NaughtsnCrosses Pty Ltd v Innovation Australia [2012] AATA 743, Deputy President Hack said:

“[A] project such as this can involve systematic, investigative and experimental activities … [however, the activities] appear to have been poorly documented and have been even more poorly evidenced.” [emphasis added] [xi]

He further said:

“[A]ssertions were made without reference to the evidence on which they [the assertions] are based.” [xii]

Hack J’s comments suggest that the R&D activities conducted by RACV could have met the eligibility requirements. But, while there was documentation, and it could have been be inferred from the nature of the activities that they would develop in a systematic, scientific method, the documents presented were inadequate in proving that requirements were indeed met. The documents presented were deemed ineligible because:

they could not be constructed in a way that helped demonstrate the experimental nature of each activity; and

any relevant documents produced were not communicated to the Tribunal in a way that assisted it in understanding that experimental nature.

Similarly, the importance of the quality of documentation is evident in the decision handed down by Deputy President McDonald in the HZXD case. The decision follows the reasoning that the claimant was unable to provide “particularisation of any testing carried out as the project advanced due to the lack of contemporaneous records”. [xiii]

McDonald J further commented that without sufficient supporting evidence, “the Tribunal [was] unable to calculate what portion, if any, of the application should be accepted as involving innovation or a high degree of technical risk … [as] … it is unknown what experiments were carried out …” [xiv]

The decisions of the HZXD, RACV, NaughtsnCrosses and DBTL cases reaffirm the long-standing AusIndustry principle that unless an R&D activity can be proven to have occurred, it cannot be assumed to have occurred.

The content of the decisions suggests that relevant documentation refers to documents that are purposeful and timely. These documents give substance to claims; they are tangible or measurable evidence of the occurrence and nature of the activities.

Case Study

Battery Co. is developing a long-life, rechargeable battery for smartphones by combining two existing chemicals in a new way to provide longer battery life (the Battery Project). As part of the design process, various theoretical calculations are performed, including computer model simulations. Battery Co. also constructed a prototype battery for laboratory testing. The prototype is constructed for the dominant purpose of supporting the R&D activities.

Considering the DBTL, HZXD, RACV and NaughtsnCrosses decisions, Battery Co. identified the following activities as part of the project:

| Activity | Description | Classification |

| Literature review | Set a benchmark for the new knowledge to be gained, through a review of existing battery technologies in smartphone applications. | Supporting |

| Conceptual and detailed design | Development of an initial product design followed by detailed calculations on its theoretical workings, including use of computer simulations. |

The core activities relate to:

- the experimental development of a battery design and testing of its performance using a computer model; and

- testing of the prototype battery in laboratory trials.

These activities are eligible as core R&D activities because the:

- outcome cannot be determined in advance based on current knowledge; ie based on the literature review, the information available is inadequate to help determine, for certain, that combining two types of existing chemicals in the method employed will extend battery life;

- scientific method is applied to test a hypothesis about the battery-life performance by experimenting with a new method, observing the results of the experiment, and evaluating the outcome in view of making a logic conclusion; and

- activities are conducted for the purpose of generating new knowledge about the improved battery design; eg if the improved design performs as anticipated, the hypothesis is proved; if the improved design fails, the hypothesis is disproved.

Hypothesis:

- Combining two types of existing chemicals in a new way will extend the battery life.

Experiment:

- Testing the battery-life performance of the new design using theoretical calculations and computer simulations.

Observation:

- Recording the results of the experiment, including computer modelling predictions and results from theoretical calculations.

Evaluation:

- Analysing and assessing the effectiveness of the predicted battery-life performance against design specifications.

Conclusion:

- Determining whether further design changes are necessary to meet design specifications.

Hypothesis:

- Combining two types of existing chemicals in a new way will extend the battery life.

Experiment:

- Testing the performance of the prototype battery in laboratory trials.

Observation:

- Recording the results of the laboratory experiments.

Evaluation:

- Analysing and assessing the effectiveness of the prototype’s battery-life performance against design specifications.

Conclusion:

- Determining whether further design changes are necessary to meet design specifications.

SUGGESTIONS FOR RELEVANT DOCUMENTATION

CORE ACTIVITIES

Application of the scientific method

To demonstrate that the scientific method was applied, the documentation may show the following:

| Scientific method | Description [xv] | Examples of relevant substantiation document |

| Hypothesis | A proposition (or set of propositions) suggested as an explanation for the occurrence of some specified group of phenomena, either asserted merely as a provisional conjecture to guide investigation (a working hypothesis), or accepted as highly probable in the light of established facts. | Statement of hypothesis in any document (eg business cases, project scopes, trial plans, test reports, close-out reports, scientific papers, etc). |

| Experiment | A test or trial; a tentative procedure; an act or operation for the purpose of discovering something unknown or testing a principle, supposition, etc. | Description of the experimental method (eg trial plans, test reports, scientific papers, close-out reports, engineering drawings, etc). |

| Observation | The act of viewing, or noting something, for some scientific or other special purpose. | Results of the experiment (eg logbook records, trial results, test reports, scientific papers, close-out reports, etc). |

| Evaluation | To ascertain the value or amount of; appraise carefully. | Discussion of results (eg alpha-test reports, close-out reports, scientific papers, etc.) |

| Logical conclusion | The science that investigates the principles governing correct or reliable inference, and then comes up with a result, issue or outcome. | Summary of findings (eg alpha-test reports, close-out reports, scientific papers, etc). |

Generation of new knowledge

The following tables provide examples of documentation that may be used to demonstrate the level of knowledge at the various stages throughout the R&D project.

| Knowledge at project commencement | Example documentation |

| Publicly available knowledge | Time-stamped literature reviews, patent searches, scientific or technical reviews, trade journals, Google search results. |

| Initial project objectives | Project scopes, business cases, Capex and Opex approvals, expenditure requests. |

| Identification of knowledge gap | Analysis of a literature review, or a range of literature reviews, and identification of potential knowledge gap. |

| New knowledge generated from R&D Design outcomes | Example Documentation |

SUPPORTING ACTIVITIES

Supporting activities must be substantiated in a way that demonstrates a direct, close and relatively immediate connection to core activities.

This relationship between the activities within the Battery Project could be depicted as two distinct groups of activities, as illustrated below:

Figure 3 – Illustration of the relationship between activities within the Battery Project

Therefore, documents should aim to demonstrate how core activities will be affected in the absence of supporting activities.

Examples of such documentation could include the following:

| Supporting activity | Example documentation |

| Literature review |

|

| Prototype construction |

|

| Product feedback |

|

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725. Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

Swanson Reed’s R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.

CHOOSE YOUR STATE